Climate change is the defining crisis of our time. As the biggest long-term threat to humanity, the global transition to a low-carbon economy is more urgent than ever. Investors now recognize the importance to manage the risks and seize the opportunities that climate change presents. Indeed, there is growing capital allocated to align investment portfolios with a low-carbon and climate resilient future. The Lion-OCBC Securities Singapore Low Carbon ETF allows you to partake in the decarbonisation journey of Singapore's real and financial economy.

Investment Objectives

The investment objective of the Fund is to replicate as closely as possible, before expenses, the performance of the iEdge-OCBC Singapore Low Carbon Select 50 Capped Index using a direct investment policy of investing in all, or substantially all, of the underlying Index Securities.

About The Index

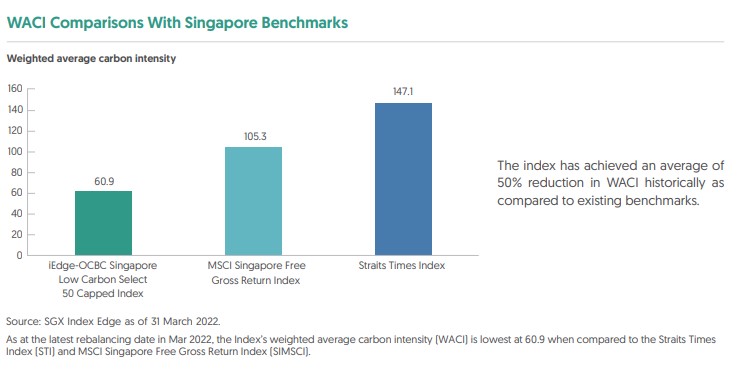

The Index is compiled and calculated by the Index Provider and aims to track the top 50 companies (including Real Estate Investment Trusts and Business Trusts) by Free-Float Market Capitalisation that are representative of Singapore’s real and financial economy, with a focus on index decarbonisation through the reduction of Weighted Average Carbon Intensity (WACI) of the Index. Index decarbonisation is achieved through selection of constituents with minimal involvement in fossil fuels, and through the implementation of the Carbon Performance Exclusion Criteria that ensures best-in-class selections based on Scope 1 and 2 Greenhouse Gas (GHG) emissions per unit revenue.

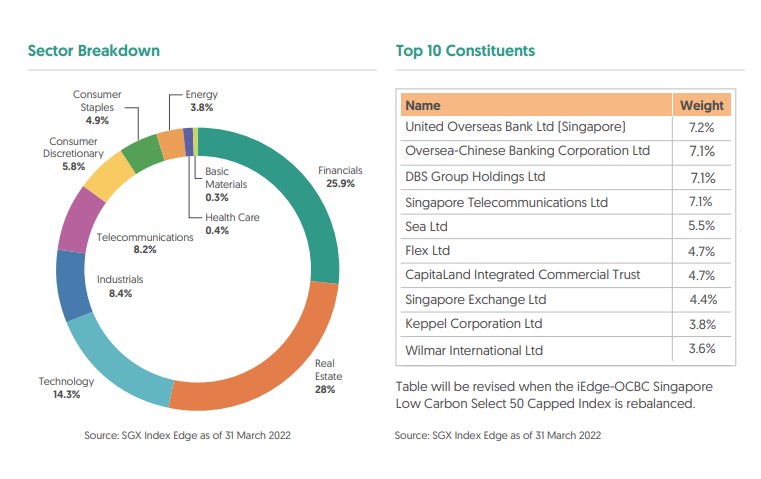

Sector Breakdown & Top 10 Constituents

Tiger Brokers (Singapore) Pte Ltd is proud to be one of the exclusive dealers to participate in the Initial Offer Period (IOP) of the LION-OCBC SECURITIES SINGAPORE LOW CARBON ETF.

Clients will be able to apply via the Tiger Trade App during the subscription period from 11 April 2022, 9am to 21 April 2022, 12pm.

For more information, please refer to the Prospectus and Brochure.

|

Name of Counter |

LION-OCBC SECURITIES SINGAPORE LOW CARBON ETF |

|

Listing Price |

SGD 1.00 |

|

Traded Currencies |

SGD and USD For the IOP, the subscription will be denominated in SGD |

|

Tiger Brokers Subscription Period |

11 April 2022, 9am to 21 April 2022, 12pm |

|

Subscription Quantity |

Min 1,000 units, in multiples of 1,000 units |

|

Allocation |

100% (i.e. if you subscribe 1,000 units, you will be allocated 1,000 units) |

|

Subscription Fees |

0.06% of the subscription amount or min SGD 10 |

|

Listing Date |

28 April 2022 (Thursday) |

Please refer to Lion Global Investors website for more information:

https://www.lionglobalinvestors.com/en/index.html

LION-OCBC SECURITIES SINGAPORE LOW CARBON ETF WEBINAR - 18 April 2022, 1.30pm

Reserve your seats here.

Speaker profile:

Ong Xun Xiang, CFA, CA

ETF Product Specialist

Lion Global Investors

Xun Xiang is an ETF Product Specialist within the Product Solutions Group at Lion Global Investors, focusing on ETF product initiatives. Before joining Lion Global Investors, Xun Xiang held the title of AVP Capital Markets at ADDX (formerly iSTOX), a MAS-licensed digital securities platform empowering investor access to private capital opportunities. Prior to ADDX, Xun Xiang built his career in BNP Paribas, with experience across institutional and private banking.

Xun Xiang graduated from Nanyang Business School with a Bachelor's Degree in Accountancy. He holds the Chartered Financial Analyst (CFA) designation as well as the Chartered Accountant (Singapore) designation.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Any views shared with Prospective Clients (“Prospects”) are suggestive in nature and on a sample basis only. This may also be predicated on assumptions that are made by Tiger Brokers (Singapore) Pte. Ltd. (“Tiger Brokers”) about the Prospects’ investment objectives and risk profile. Our suggestive and sample views extended to Prospects are not to be considered as recommendations made by Tiger Brokers. Suggestions provided are also based on information that may be shared by the Prospects, the accuracy and comprehensiveness of which Tiger Brokers is not in a position to verify.

Tiger Brokers may, to the extent permitted by law, participate or invest in other transactions with the issuer of the products referred to herein, perform services or solicit business from such issuers, and/or have a position or effect transactions in the securities or options thereof. The information herein is for recipient’s information only and not an offer to sell or a solicitation to buy. Any date or price information is indicative only and may be changed without prior notice. All opinions expressed and facts referred to herein are subject to change without notice. The information herein was obtained and derived from sources that we believe are reliable, but while reasonable care has been taken to ensure that stated facts are accurate and opinions are fair and reasonable, Tiger Brokers does not represent that it is accurate or complete and it should not be relied upon as such. The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future stock performance. Investment involves risk. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any person or affiliated companies. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, objectives and circumstances. Tiger Brokers assumes no fiduciary responsibility or liability for any consequences financial or otherwise arising from trading in securities if opinions and information in this document may be relied upon.